Top 5 Payment Platforms for Remote Workers in Nigeria

Check the top 5 payment platforms in Nigeria to receive your hard earned freelancing funds from clients around the world.

Remote work opened doors for Nigerians to collaborate with international clients. But this exciting opportunity comes with a hidden hurdle: getting paid seamlessly. Navigating different currencies, complex payment systems, and hefty fees can turn those hard-earned dollars into mere cents before they reach your Nigerian account. Frozen accounts, disappearing funds, and vanishing profits are everyday frustrations for countless Nigerian remote workers struggling to manage international payments.

This article highlights the top 5 payment platforms that can simplify cross-border transactions and ensure your remote work rewards reach your pocket.

TOP 5 PAYMENT PLATFORMS FOR REMOTE WORKERS IN NIGERIA

GEEGPAY

Geegpay is a global banking firm designed for African professionals. It's a payment gateway that offers a rapid and effortless way to receive international payments, without unnecessary charges.

Features:

- Virtual Accounts: Effortlessly accept payments from around the world with virtual bank accounts in United States Dollars (USD), British Pounds (GBP), and Euros (EUR). Plus, enjoy the convenience of a USD virtual debit card for your global spending.

- Free transfers with Geegpay Tag: Easily send and receive money from friends and loved ones at no cost, using your Geegpay tag or email.

- Multi-currency Wallet: Manage all your currencies in one place.

- Multi-withdrawal channels: Access your funds anywhere with withdrawals to banks, mobile money in over 100 countries, and popular platforms like Paypal, Payoneer, Wise, and Revolut.

3 Simple Steps to Set Up Your Geegpay Account:

- Create an Account: Sign up with your legal name, create a strong password, and confirm the email verification code within 5 minutes.

- Verify Your Account: Complete your profile details, including bank information, employment details, and identity verification.

- Create Your Bank Accounts & Debit Cards: Now you're ready to receive and spend your international payments effortlessly.

How to receive payments from clients abroad as a Nigerian

— By Thanni (@bythanni) November 29, 2023

Payoneer + @greyfinance or Local Bank Dom

You can use Payoneer via the "request payment" feature or from a marketplace (e.g. Upwork).

GREY

Grey (formerly Aboki Africa), is among the thriving African startups selected for Y Combinator's Winter 2022 batch (YC W22), the largest batch for African startups. You can't mention payment options without talking about Grey.

Grey is designed to help Africans get virtual foreign accounts for receiving and sending international payments online. Unlike most financial apps, it also allows you to make direct transactions and payments through the website. However, for local currency conversions, it currently supports only the Nigerian Naira.

Features:

- Global Bank Accounts: Open US, UK, or EU bank accounts in minutes! Receive and manage global payments – all for free, with zero account & card maintenance fees.

- Currency Exchange: Seamlessly swap currencies at competitive rates. Convert local to foreign and back in an instant.

- Virtual Cards: Make international payments smoothly and securely with virtual debit card.

- Seamless Money Transfer: Send and receive money easily with clients and loved ones, in both foreign and local currencies.

How to Create a Virtual Foreign Bank Account on Grey

- Download the app or go to Grey.co to sign up and verify your email address.

- Next, upload a valid ID card (driver's license, national ID, or international passport) to complete your KYC verification.

- Verify and sign in to your account.

- On your dashboard, click on 'Accounts' on the right side of your screen.

- Choose your preferred virtual account and fill in your valid ID details.

- Enter your address details, provide a recent utility bill to confirm your address, and click 'Finish'

- Your virtual account application will be reviewed and you'll be notified. Once approved, you can start sending and receiving money online.

PAYONEER

Payoneer empowers millions of businesses and professionals across 190+ countries to expand their reach. Get paid, make payments, access funds, and manage your money effortlessly with Payoneer's cross-border payment platform.

Payoneer offers a multi-currency receiving account that allows you to receive payments in different currencies, which can be withdrawn to your Nigerian account.

Features:

- Receive Payments in Multiple Currencies: Get paid easily to your local bank accounts in USD (US Dollar), EUR (Euro), GBP (British Pound), JPY (Japanese Yen), AUD (Australian Dollar), and CAD (Canadian Dollar).

- Flexible payment: Send payment requests to international clients and receive them via local bank transfer, debit/credit card, or ACH bank debit.

- Virtual/Physical Cards: With a Payoneer account, you can seamlessly handle global business expenses using the Payoneer Commercial Mastercard®. You can choose between a virtual or physical card, each offering unique advantages for managing international payments.

How to create a Payoneer Account

- Visit Payoneer.com and click on the 'Open your Account' button.

- Next, pick the right account type for your business needs.Choose from options like Freelancer or SMB, Online Seller, Affiliate Marketer, Vacation Rental Host, or Individual.

- Click the 'Register' button, and sign up to Payoneer by filling in your first name, last name, email address, and date of birth.

- Confirm your email address by logging into your inbox and clicking on the link from Payoneer.

BINANACE P2P

Binance P2P (Peer-to-Peer) was created to enable P2P Bitcoin exchange transactions using local currencies. If you're working with a web3 client or your client has agreed to pay with crypto, Binance is a great option for you.

Features:

- Ads Posts: P2P users can post free trade ads to buy and sell crypto with fiat currencies.

- Zero Fees: One major advantage of Binance P2P is its zero fees. Unlike many other P2P platforms, you don't pay any transaction charges through Binance P2P, meaning you keep what you trade.

- Multiple Payment Methods: With more than 150 payment methods available, Binance P2P ensures you can find the perfect way to send or receive money for your trades.

- Fast Transactions: You can complete secure P2P trades in 15 minutes or less with selected merchants.

- Binance P2P secures your P2P trades with escrow. It holds crypto involved in deals, stopping theft and scams by ensuring everyone completes their part of the deal before funds change hands.

How to Setup a Binance Account

- Go to Binance.com or download app and choose "Sign up with Email or Phone".

- Enter your email address or phone number, then verify with the 6-digit code sent.

- Create a strong password for your account.

- Complete your Identity Verification through the Binance app if you registered on the website.

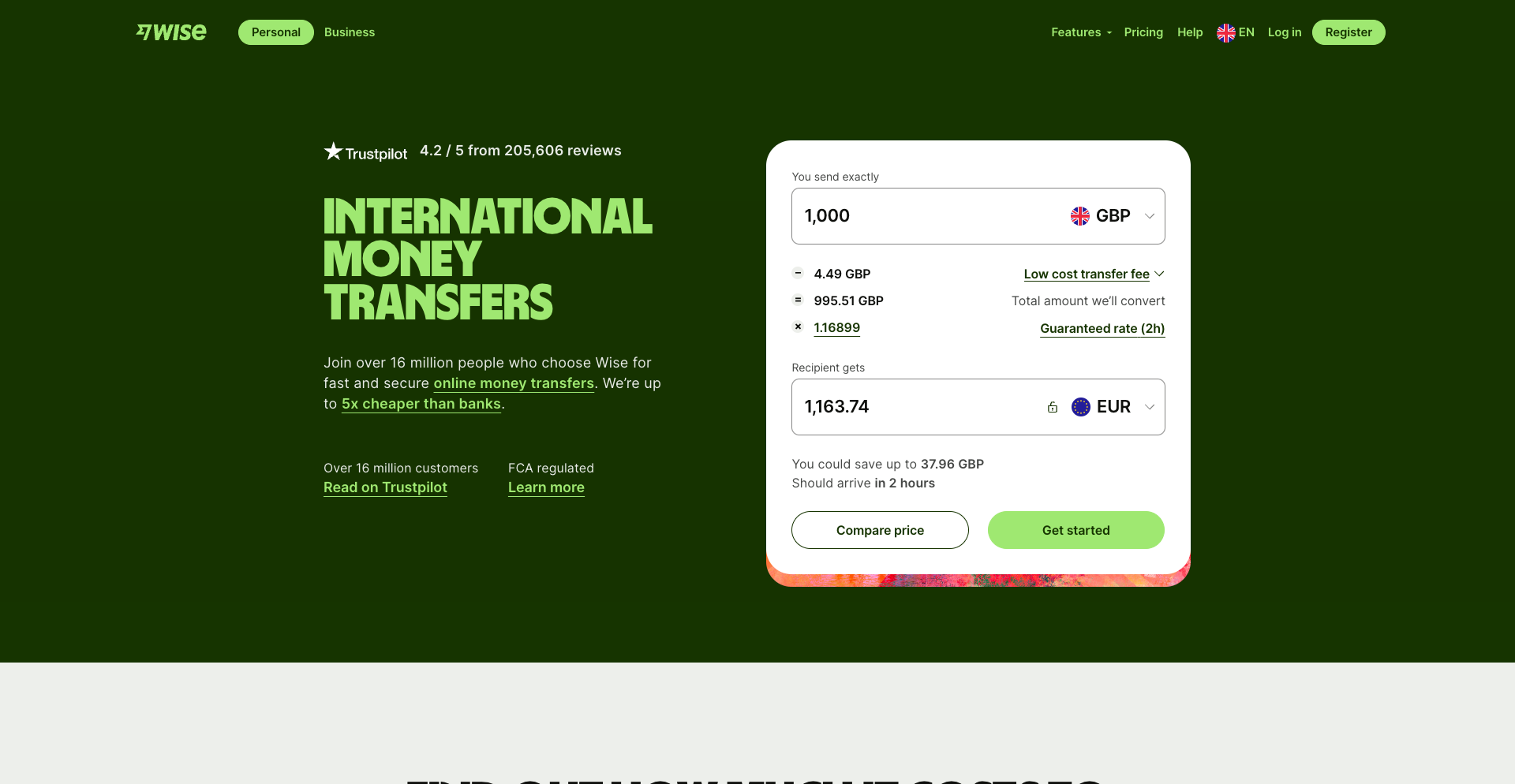

WISE

Wise, formerly known as transferwise, can help you receive payment from over 70 countries. You can transfer money directly between banks, from your own account, or through your Wise debit card.

Wise also acts as a convenient savings account, allowing you to hold your money securely. Dedicated fraud and security teams work around the clock to keep your money safe. When you open your Wise account, you'll enjoy the protection of two-factor authentication, ensuring your funds are held securely with established financial institutions.

Features:

- International debit card: Spend abroad at the real exchange rate, without hidden fees.

- Large amount transfers: Send large sums effortlessly with transparent costs. No exchange rate markups, and all fees are shown upfront.

- Mass payments: Simplify bulk payouts with the Batch Payments tool, sending up to 1,000 transactions at once.

- 2-factor authentication: This is to enhance your account security.

How to Create a Wise Account

- Visit wise.com and click "Open an Account".

- Enter your email address and choose your account type (personal or business).

- Provide your phone number and enter the verification code sent to it. Click "submit" to create your Wise account.

- Verify your account by following these guidelines.

Conclusion

Navigating diverse payment platforms as a remote worker can be tricky, but choosing the right one can help significantly. With the best 5 payment options listed above, accessing international payments becomes easy and reliable. No need to worry about currency conversions or cross-border fees! Each platform caters to different needs, so weigh your preferences and consider factors like fees, ease of use, and global reach. Which one do you think best aligns with your specific setup and desired features?